The MacroTourist himself, Kevin Muir, joined us on Talking Markets yesterday, on what was a very quiet day for markets (not).

THE “REST OF THE WORLD” TRADE

While Kevin thinks we may have the all-clear for now, after President Trump walked back on Greenland-related tariffs, he says there is “damage being done over the long run by these policies.”

“As a Canadian, we woke up in the middle of the night and our partner of many years just punched us in the face,” he said. “And then said, ‘hey do you want to talk about it?’ And then punched us again and said, ‘be careful or we’ll lock you in the basement.’”

That long-term damage strengthens Kevin’s conviction on the ‘rest of the world’ trade. Markets worldwide outperformed the US last year, both nominally:

And in US dollar terms:

And Kevin thinks ex-US markets will outperform again this year. He said it’s a by-product of this new reality where governments are going to need to spend on defense but make investments to grow the economy.

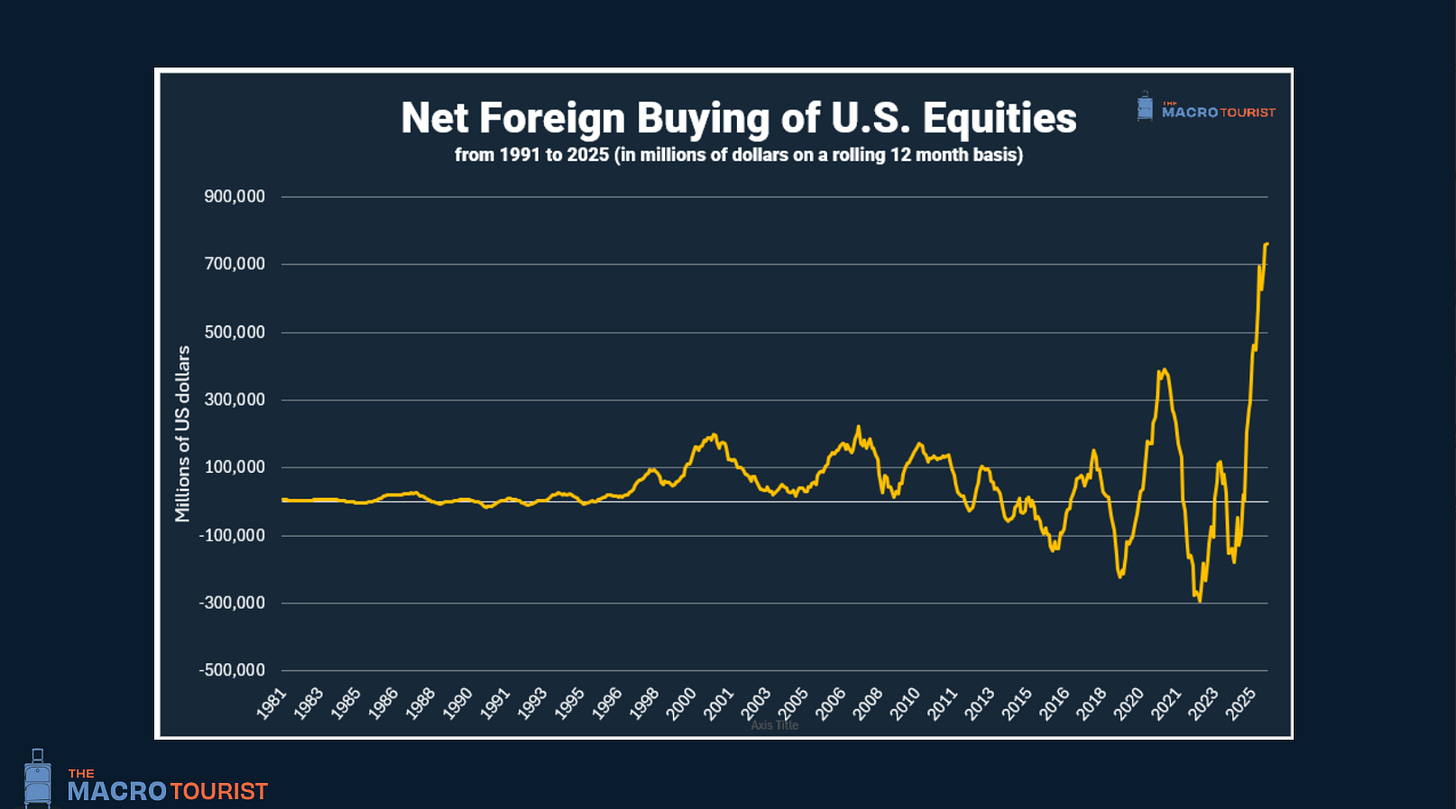

In order to do that they need to have some of the huge amounts of capital that went into US assets repatriate back home. Some of that will happen because of attractive valuations vs. US, but some will be encouraged by government policy, such as the one he talked about in The Macro Tourist recently (link below), where “South Korea changed the tax rules to encourage its citizens to sell overseas stocks (read US) and reinvest proceeds in the local South Korean market.”

💡”Trade the market that’s in front of you instead of the market you want,” Kevin said. “I can sit and give you my opinion on what Trump should or shouldn’t be doing, but it doesn’t matter. As traders and investors, we should be focused on what will be done, not what should be done.”

THE “MOST IMPORTANT CHART OF 2026”

Drum roll, please…

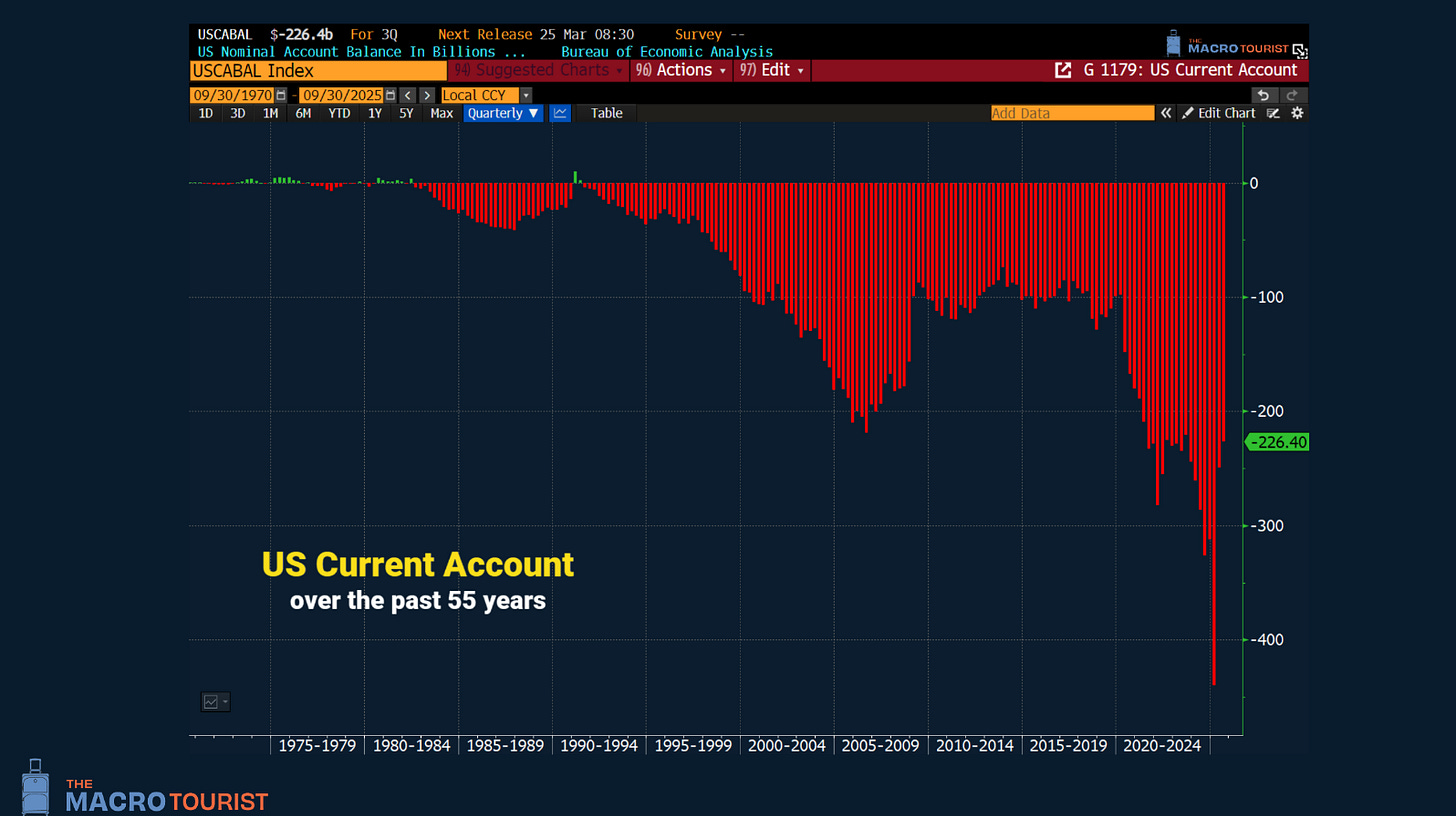

Part of the reason the US stock market has been so strong is that the US was willing to run the largest fiscal deficit and willing to buy everything from around the world, Kevin said. Because in theory, if the US was buying a bunch of stuff from a particular country, that currency should rise, but in a lot of cases, those countries didn’t want it to rise. “So they said ‘hey listen, we’ll take your US dollars and instead of converting it into our country, we’ll leave it in US dollars and buy your financial assets,’” he said. “So this is part of this super bubble we’ve seen in financial asset prices, which is the other side of the trade deficit.”

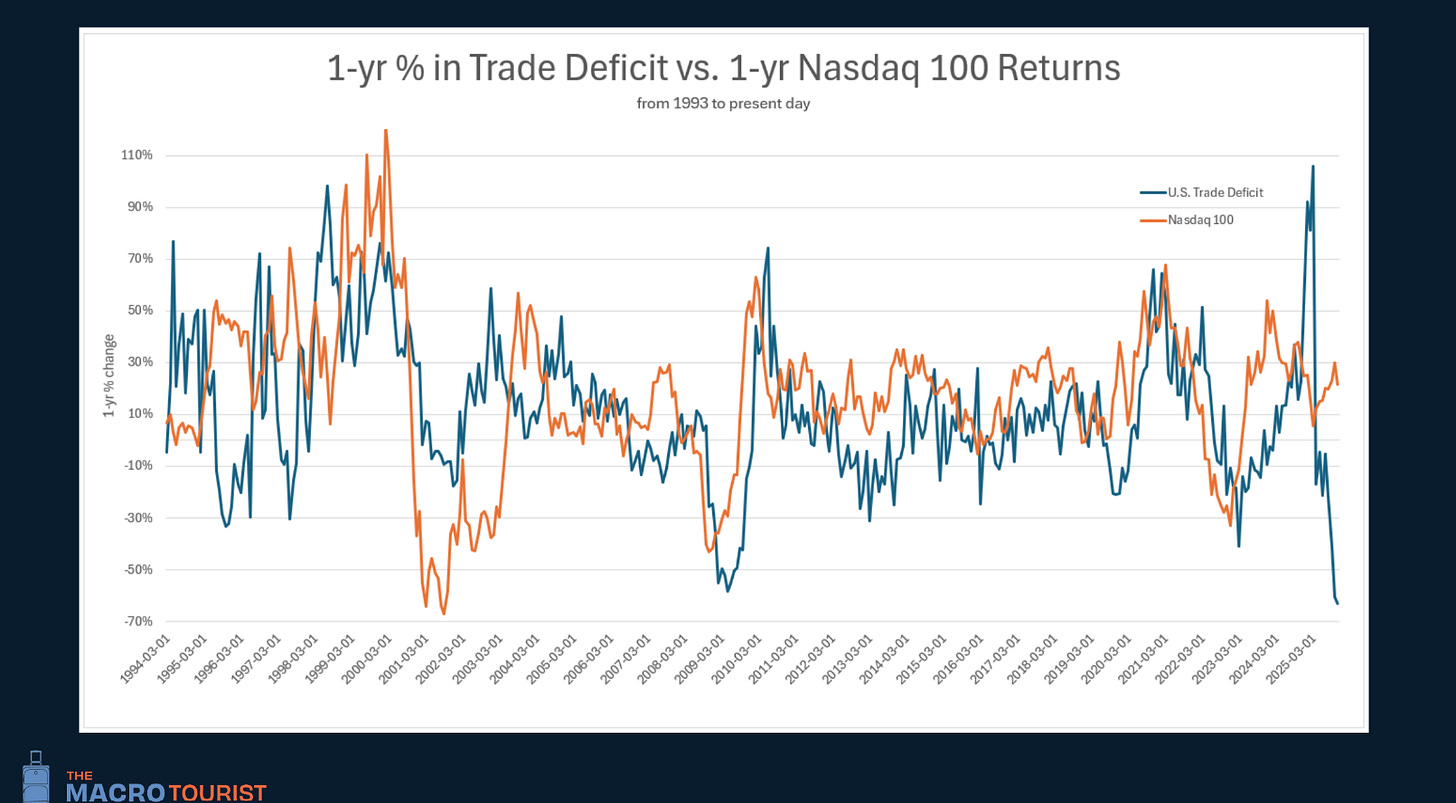

So, if the US is going to lower their current account deficit (above), the other side of that is lower financial asset prices, Kevin said. Really? Yes, really:

“In essence, when the trade deficit increases, the NASDAQ increases, and when the trade deficit declines, the NASDAQ declines,” he said.

THE ROTATION… ISH

“It makes better TV for me to say it’s going to be the end of the world and the US is going to go no bid, but that’s not the way it works,” Kevin said. But there certainly is a rotation happening:

Mag 7 broke support, it’s been 4 months since QQQ has had a new high

Small caps “have taken off” since the new year

Aluminum took off

Chemicals are going well

Energy is finally looking bid

He sees a lot of correlation to the dot-com bust. He mentioned that in the year 2000, the year tech imploded, a ton of stuff was actually up, e.g.:

Utilities up 30%

Insurance up 24%

Transportation up 24%

“There’s a lot of money to be made on the rotation, and I think what we’ve seen so far this year is the start of this rotation,” he said. “If you just want to be trading from the long side, there are plenty of opportunities out there, so stop worrying about the Mag 7.”

💡”If I were running a portfolio, I would have the highest amount of non-US stocks that I possibly could,” he said. Money rushed into the US on the AI trade (below), but if that rotation out happens/continues, then the US won’t be the place to be. And in that case, he also thinks it means the US dollar is headed a lot lower.

IS THE SILVER TOP IN?

Kevin thinks so, though he said “this is either a hero call or I’m going to look completely foolish.” He first made the call a couple of days ago and has survived so far…

He thinks silver is due for a flush that “cleans out everyone and makes it safer in the future.” It’s a sentiment thing really, it now just “feels like everyone’s in it.”

🏚️Housekeeping note: For paying Market House subscribers, we’ll have a Macro Sessions for you later today with Rick Rule, where he also discusses silver. Stay tuned…

KEVIN ON…

ENERGY

“Energy is dirt cheap. I think energy stocks are what gold stocks were last year, for a lot of reasons…. People still hate energy [right now].”

🪢More from Kevin on energy here.

VOLATILE MARKETS

“When it gets more volatile, you have to trade smaller. The reality is that the market is still very unstable. The damage that Trump is doing in terms of making the system less stable just increases by the day.”

AND FINALLY… DIP SHMIP

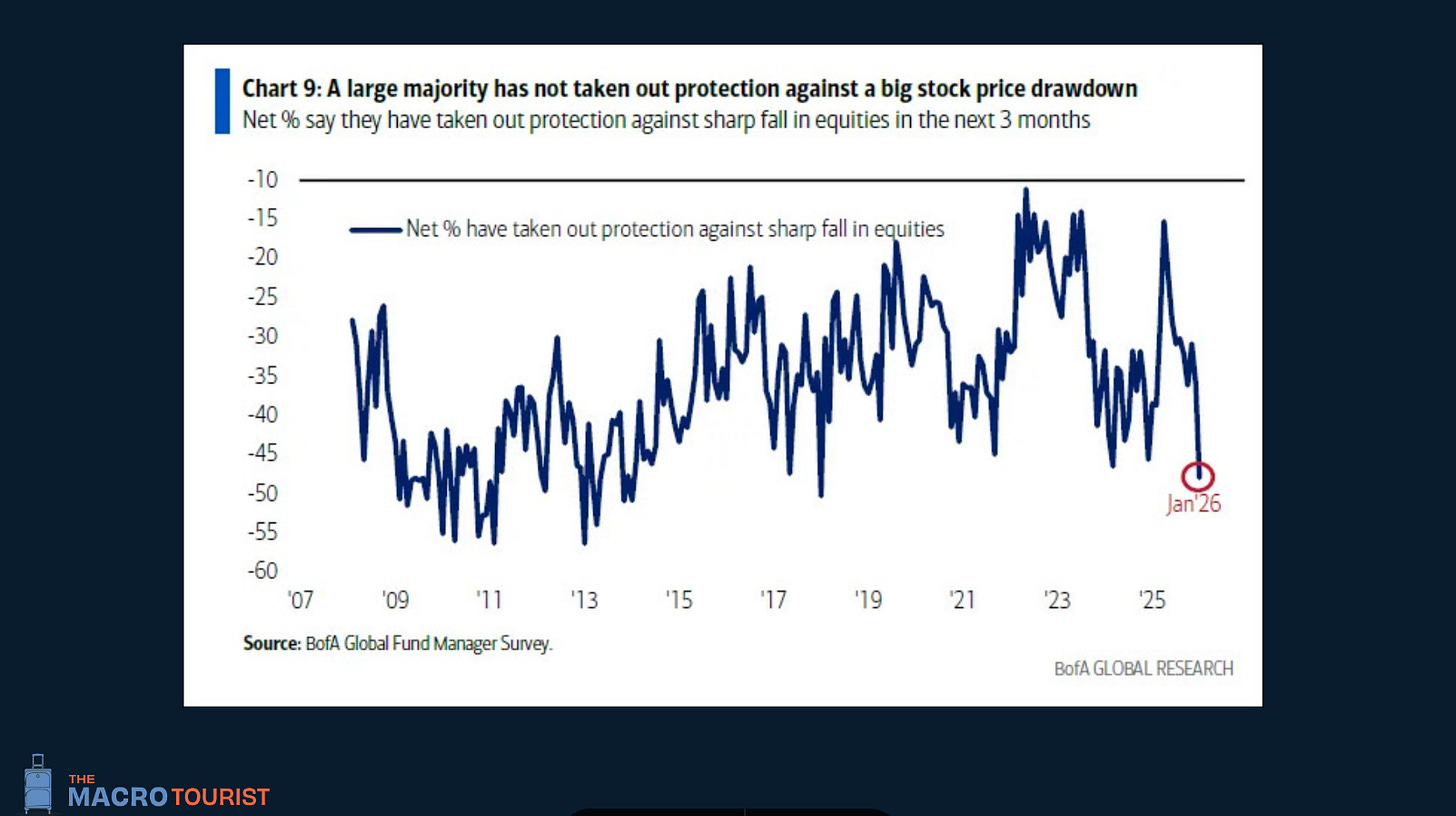

This chart “is kind of showing that everyone is giving up hedging,” Kevin said.

Be careful out there…

Thank you The Blind Squirrel, Rich C, Harry Newton, Joe Cooper, George, and many others who tuned in live…! And thank you Kevin Muir for your fantastic chart deck 🫡

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and overall financial plan.